Opening Balance in Account

By Tinut on November 3, 2022

BeginnerOpening Balance in Account

The opening balance is the balance that is brought forward at the beginning of an accounting period from the end of a previous accounting period or when starting out.

This also applies when starting a new Company and would like your offline balances to be updated in ERPNext.

1. Introduction

If you are a new company, you will have minimal opening balances to be imported. However, if you are migrating from a legacy accounting system like Quickbooks ,Localized...etc you will have considerable data to be imported as opening balance.

We recommend that you start using ERPNext for accounting from a new financial year, but you could start midway too. To set up your accounts, you will need the following for the “day” you start using accounting in ERPNext:

Assets

1. Stock assets (stock in hand).

2. Fixed assets like furniture, computers, etc.

3. Accounts Receivables (AR) i.e. unpaid invoices which you have sent to your Customers.

4. Current assets like bank balances, cash in hand, deposits, etc.

Liabilities

1. Capital accounts like your shareholder’s (or owner’s) capital.

2. Current liabilities like loans, salary payables, etc.

3. Accounts Payables(AP) i.e. unpaid invoices which your suppliers have sent you.

If you were using another accounting software before, you should close financial statements in that software first. The closing balance of the accounts should be updated as an opening balance in the ERPNext. Before starting to update the opening balance, ensure that your Chart of Accounts has all the Accounts required.

Opening entries can be created using the Opening Invoice Creation Tool in ERPNext.

Opening entry is only for Balance Sheet accounts and not for Profit and Loss Accounts.

2. Opening Balance of Assets

1. Fixed Assets

To import all the existing fixed assets first, create the asset record and then create a Journal Entry to update General Ledger.

1.1. Create Asset Records

Create an Asset record for each asset that your company owns which is not fully depreciated.

To create a new Asset:

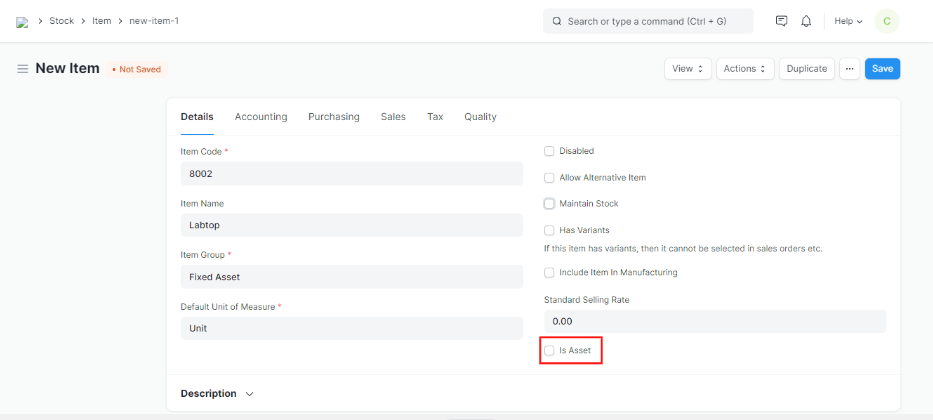

1. Create an Item with "Is Asset" enabled.

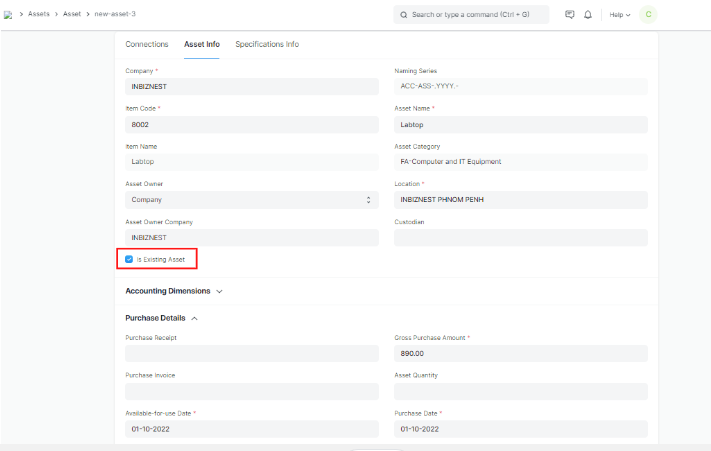

2. Go to Assets > Assets > New.

3. Enter Asset Name.

4. Enter Item Code.

5. Enter Location.

6. Enter the Purchase Date in Purchase Details.

7. Enter Gross Amount in purchase Details.

8. Tick Is Existing Asset.

9. Save.

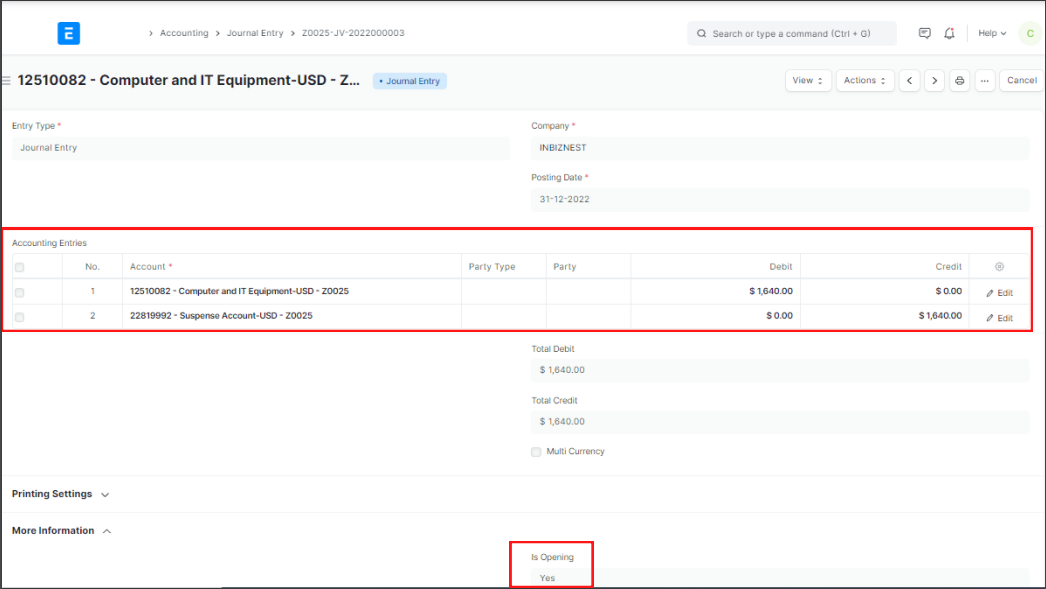

1.2 Create Journal Entry to Update the Ledgers

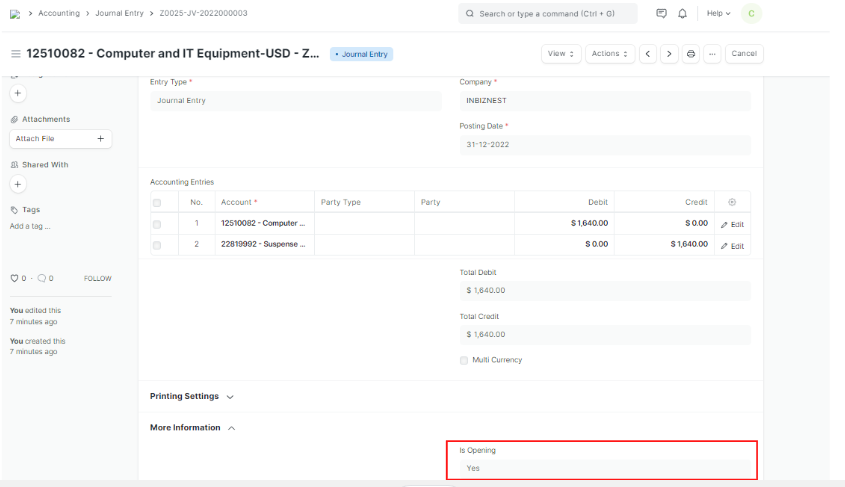

When you create an Asset with the 'Is Existing Asset' checkbox ticked, General Ledger is not updated. You will have to update the value via a Journal Entry.

To create a new Journal Entry:

1. Go to: Accounting > General Ledger > Journal Entry > Add Journal Entry.

2. Enter the Posting Date.

3. Select the appropriate fixed asset ledgers in the Account column and enter the value in the Debit column (Total Amount of Existing Asset).

4. Select the "Temporary Opening Account" ledger in the Account column and enter the balancing amount in the Credit column.

5. Set "Is Opening" to Yes.

2. Stock Assets

Opening Stock is the amount and value of materials that a company has available for sale or use at the beginning of an accounting period.

The closing Stock of the previous accounting period becomes the opening Stock of the current accounting period.

2.1 Prerequisites

1. Create Warehouses.

2. Link Warehouse to appropriate accounting ledgers.

2.2 Opening Stock for Non-serialized Items .

To post opening stock visit the Stock Reconciliation page.

2.3 Opening Stock for Serialized and Batched Items

Create the Batch and Serial No records beforehand.

To post opening stock for serialized and batched items:

1. Go to Stock > Stock Transactions > Stock Entry > New.

2. Select "Material Receipt" in 'Stock Entry Type.

3. Select the Warehouse in 'Default Target Warehouse'.

4. In Items table select Item Code, Qty, and Basic rate.

5. For batched items select "Batch No" by go to stock > Item and pricing > item >select Item > inventory > Serial Nos and Batches.

6. For serialized items select "Serial No" by go to stock > Item and pricing > item >select Item > inventory > Serial Nos and Batches

7. Save and Submit.

3. Accounts Receivable

Accounts Receivables is the balance amount your Customer owes you towards the Sales Invoices you have already sent to them.

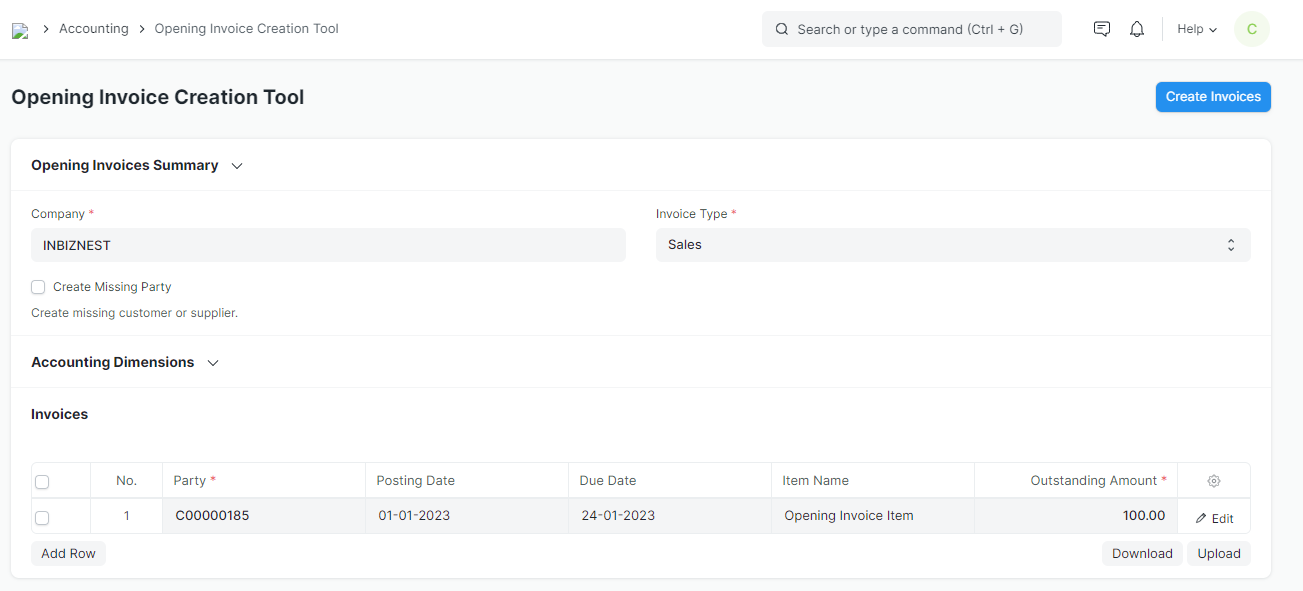

You can import the accounts receivable details using the Opening Invoice Creation Tool.

To access it :

Go to: > Home > Accounting > Opening and Closing > Opening Invoice Creation Tool

3.1 How to import outstanding invoices

1. Go to the Opening Invoice Creation Tool.

2. Select the Company.

3. Select Sales in Invoice Type.

4. Click on Add Row and select customer in the party, select Posting Date, Due Date, Item Name and add Outstanding Amount.

5. Click on edit and select "temporary Account" in chart of account.

6. Click on Create Invoices. Sales Invoices will be created.

You can post Payment Entry against these invoices as and when you receive payment from your customer.

4 Current Assets

Before importing current assets, make sure that you have created the required ledgers under Chart of Accounts > Assets > Current Assets group.

1. How to import details of current assets

1. Go to: Accounting > General Ledger > Journal Entry > Add Journal entry

2. Enter the Posting Date.

3. Select the appropriate current asset ledger in the Account column and enter the value in Debit.

4. Select the "Temporary Opening" ledger in Account and enter the balancing amount in Credit.

5. Set 'Is Opening' to Yes.

3. Opening Balance of Liabilities

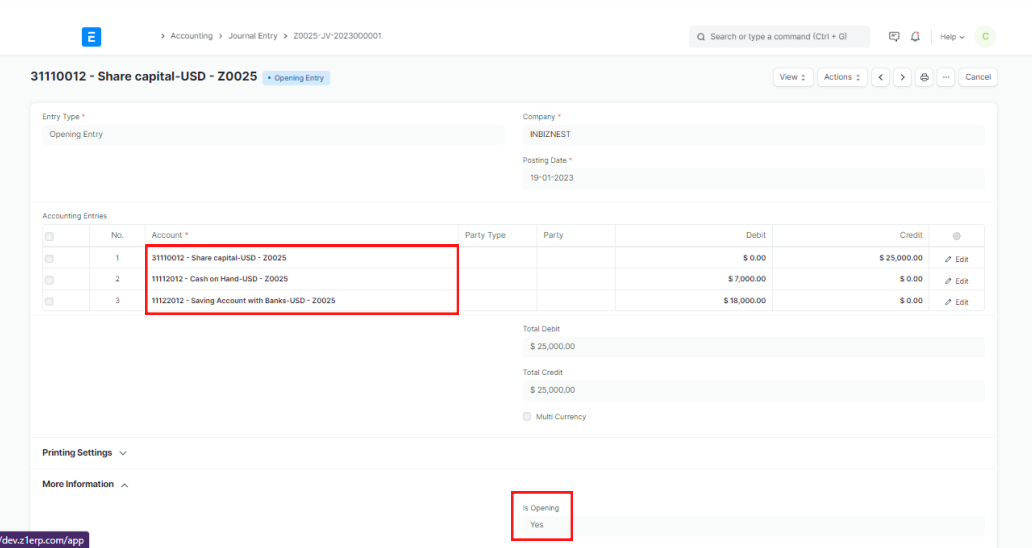

3.1. Capital Accounts

Before importing capital accounts, make sure that you have created the required ledgers under Chart of Accounts > Equity Accounts group.

To import details of capital accounts:

1. Go to: Accounting > General Ledger > Journal Entry > Add Journal Entry .

2. Enter the Posting Date.

3. Select the appropriate capital account ledgers in the Account column and enter the value in the Credit column.

4. Select the 'Temporary Opening' ledger in Account and enter the balancing amount in the Debit column.

5. Set 'Is Opening' to Yes.

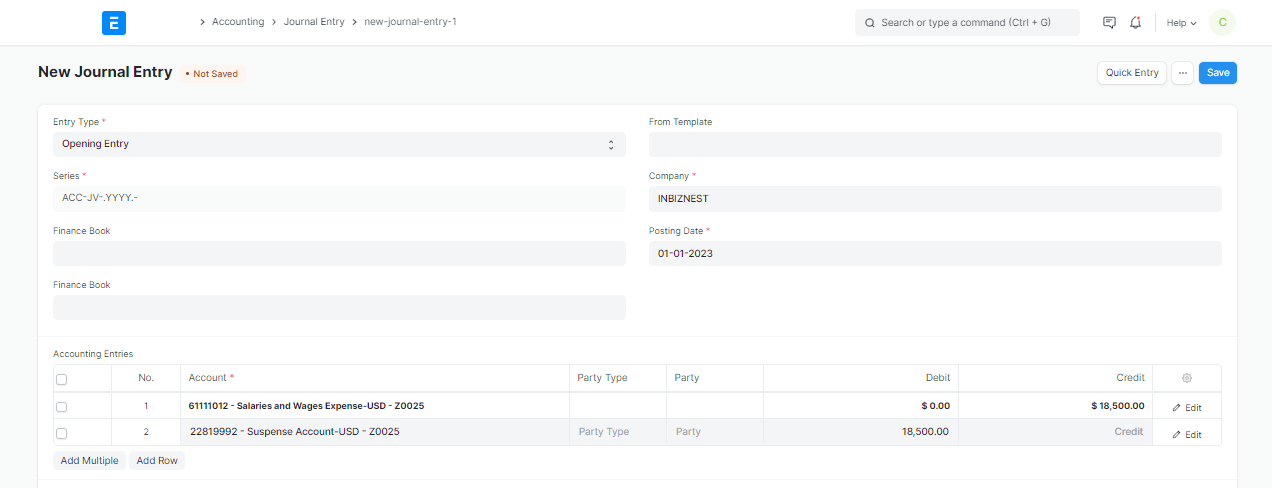

3.2. Current Liabilities

Before importing current liabilities, make sure that you have created the required ledgers under Chart of Accounts > Liabilities > Current Liabilities group.

To import details of current liabilities:

1. Go to: Accounting > General Ledger > Journal Entry > Add Journal Entry.

2. Enter the Posting Date.

3. Select the appropriate current liability ledgers in the Account column and enter the value in the Credit column.

4. Select the "Temporary Opening" or " Against accounts" ledger in Account and enter the balancing amount in the Debit column.

5. Set Is Opening to "Yes" under More Information feature.

3.3 Accounts Payable

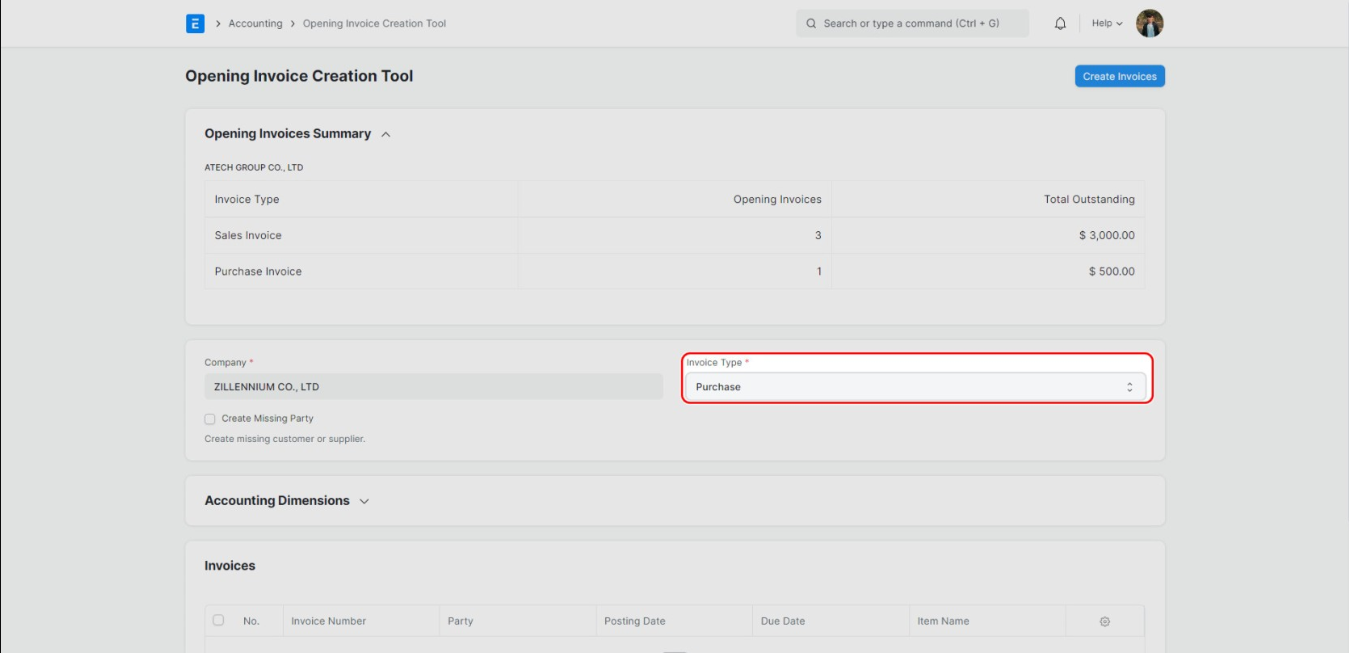

Accounts Payables is the balance amount you owe your Suppliers towards the invoices they have already sent you.

You can import the accounts payables details using the Opening Invoice Creation Tool.

To access it:

Go to: > Home > Accounting > Opening and Closing > Opening Invoice Creation Tool.

How to import outstanding invoices

1. Go to the Opening Invoice Creation Tool.

2. Select the Company.

3. Select Purchase in Invoice Type.

4. Click on Add Row and select supplier in the party, select Posting Date, Due Date, Item Name and add Outstanding Amount.

5. Click on Create Invoices.

More articles on Accounting